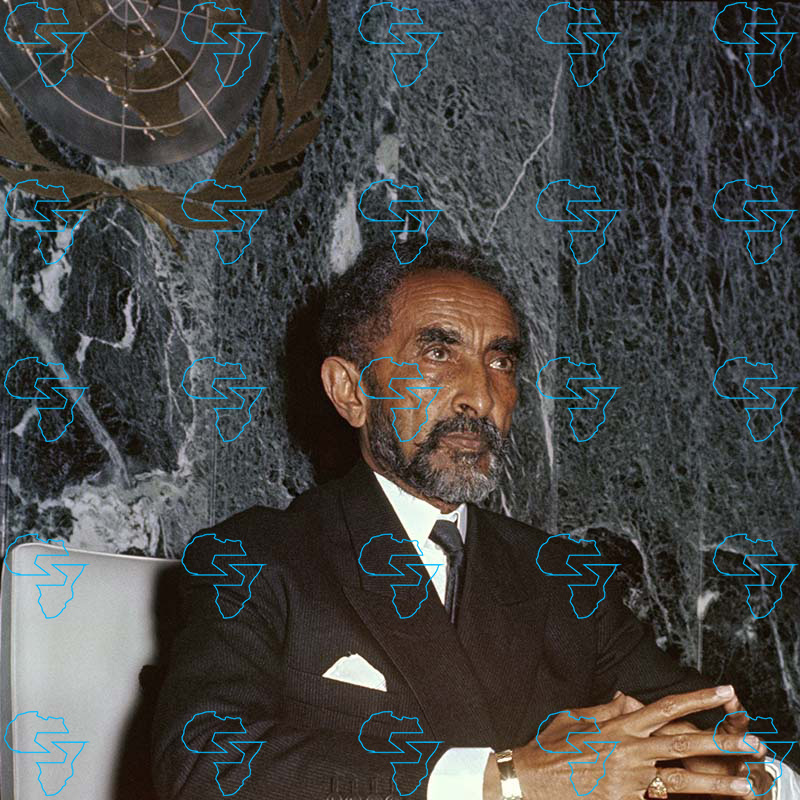

Emperor Haile Selassie I of Ethiopia and President at the United Nations

£74.02 – £2,130.12Price range: £74.02 through £2,130.12

Emperor Haile Selassie I of Ethiopia and President at the United Nations

Please remember that for this replica, that sizes beyond 24 x 20 will be slightly blurred due to the negative exceeding the recommended print size (< 300dpi).

|

Related products

-

Emperor Haile Selassie I of Ethiopia and President Muhammad Anwar al Sadat (Egypt)

Select options This product has multiple variants. The options may be chosen on the product page -

HIM Haile Selassie I and His Majesty King Hussein of Jordan

Select options This product has multiple variants. The options may be chosen on the product page -

Emperor Haile Selassie I of Ethiopia Addresses the Organisation of African Unity

Select options This product has multiple variants. The options may be chosen on the product page -

HIM Haile Selassie I welcoming His Excellency Dr Sarvepalli Radhakrishnan, President of India

Select options This product has multiple variants. The options may be chosen on the product page -

HIM Haile Selassie I, Queen Elizabeth II and Prince Philip

Select options This product has multiple variants. The options may be chosen on the product page -

Emperor Haile Selassie I of Ethiopia and King Hussain of Jordan

Select options This product has multiple variants. The options may be chosen on the product page -

Emperor Haile Selassie I of Ethiopia and Mohammad Reza Shah Pahlavi (Iran)

Select options This product has multiple variants. The options may be chosen on the product page -

Emperor Haile Selassie I of Ethiopia and Sami Süleyman Gündoğdu Demirel

Select options This product has multiple variants. The options may be chosen on the product page -

Emperor Haile Selassie I of Ethiopia and Jomo Kenyatta (Kenya)

Select options This product has multiple variants. The options may be chosen on the product page -

Ababa’s Menelik Square in 1973 at a ceremony

Select options This product has multiple variants. The options may be chosen on the product page -

HIM Haile Selassie I, His Excellency President Jomo Kenyatta of Kenya and his wife.

Select options This product has multiple variants. The options may be chosen on the product page

Basket

Product categories

Products

-

Man with arm in lion’s mouth

£74.02 – £2,130.12Price range: £74.02 through £2,130.12

Man with arm in lion’s mouth

£74.02 – £2,130.12Price range: £74.02 through £2,130.12

-

Emperor Haile Selassie I of Ethiopia Addresses the Organisation of African Unity

£74.02 – £2,130.12Price range: £74.02 through £2,130.12

Emperor Haile Selassie I of Ethiopia Addresses the Organisation of African Unity

£74.02 – £2,130.12Price range: £74.02 through £2,130.12

-

Emperor Haile Selassie I of Ethiopia and King Hussain of Jordan

£74.02 – £2,130.12Price range: £74.02 through £2,130.12

Emperor Haile Selassie I of Ethiopia and King Hussain of Jordan

£74.02 – £2,130.12Price range: £74.02 through £2,130.12

-

HIM Haile Selassie I welcoming His Excellency Dr Sarvepalli Radhakrishnan, President of India

£74.02 – £2,130.12Price range: £74.02 through £2,130.12

HIM Haile Selassie I welcoming His Excellency Dr Sarvepalli Radhakrishnan, President of India

£74.02 – £2,130.12Price range: £74.02 through £2,130.12

-

The Ethiopian Orthodox Cross

£74.02 – £2,130.12Price range: £74.02 through £2,130.12

The Ethiopian Orthodox Cross

£74.02 – £2,130.12Price range: £74.02 through £2,130.12