WB Ethiopia office points to incongruences in parallel and official forex rates

Difficulties in determining average foreign exchange rates have led the World Bank to temporarily omit Ethiopia from this year’s edition of its annual update on gross national income per capita classification, potentially affecting the country’s ability to access foreign finance.

Venezuela is the only other country under a “classification suspension”, which also marks Ethiopia’s first absence from the report since the World Bank Group began publishing national GNI data in 1987.

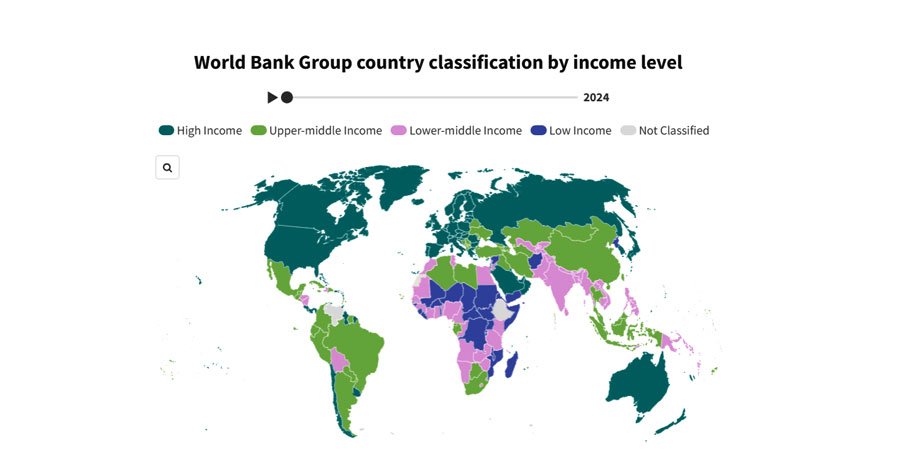

Each year, the World Bank classifies world’s economies into four income groups (low, lower-middle, upper-middle, and high) based on the previous year’s Gross National Income per capita, expressed in US dollars.

In an email interview, the World Bank Ethiopia office told The Reporter that Ethiopia’s suspension is rooted in the disparity between official and parallel foreign exchange market rates and the tremendous shifts the forex market has undergone over the past year as part of the administration’s economic reforms.

– Advertisement –

“The WB generally uses the official exchange rate as reported to the IMF to convert local currency units into US dollars. However, this exchange rate is not always reflective of the economic reality. Certain countries maintain dual or multiple official rates, often accompanied by active parallel market segments. To ensure accurate representation in underlying statistics, a composite exchange rate should be used. This approach provides a more accurate reflection of actual market transactions and improves the comparability across countries,” reads the response.

“In the case of Ethiopia, there has been an active parallel market for several years and the spread between the official and parallel market rates was significant and had reached above 100 percent prior to the launch of the economic reform program in July 2024,” the WB Ethiopia office told The Reporter.

The World Bank notes the official exchange rate has largely converged with the parallel rate since the currency was floated a year ago, and says using the official exchange rate that prevailed before July 2024 could be potentially misleading.

“Thus, to allow more time to determine a suitable exchange rate and to carefully examine the implications of the reforms on the exchange rate, Ethiopia has been temporarily suspended from the income classification,” reads the response.

A country’s income classification not only reflects its level of development, but it also has the potential to influence its development trajectory. It affects eligibility for official development assistance and concessional financing, reads a WB Group blog.

“Since the late 1980s, the classification of countries into income categories has transformed. The number of low-income countries has steadily declined, while the number of high-income countries has increased,” reads the intro to the bank’s classification for the year 2026. “This shift reflects broader global economic developments, including sustained growth in many developing countries, greater integration into the global economy, and the effects of policy reforms and international organizations’ support.”

In 1987, nearly a third of reporting countries were classified as low-income and a quarter as high-income countries. By 2024, these ratios shifted to 12 percent low-income and 40 percent high-income, according to the update.

Nearly half of all countries in Sub-Saharan Africa are classified as low-income, down from 75 percent four decades ago.

.

.

.

#Ethiopia #Risks #Jeopardizing #Foreign #Financing #World #Bank #Classification #Suspension

Source link